Valuing for a fixed rate bond

2. July 2025

How to Stay on Top of KID Requirements

5. November 2025

The 10 Most Common PRIIP KID Reporting Mistakes

And How to Avoid Them

Creating PRIIP KIDs is a complex task that requires precision, consistency, and scalability. Yet many firms continue to struggle with avoidable mistakes that affect both quality and compliance.

The cost of compliance failures has risen dramatically: The European PRIIP market represents € 10 trillion in investment products, a massive market where compliance errors can cost millions. At the same time, studies show that the cost of non-compliance is 2.71 times higher than the cost of proper compliance measures.

Based on years of experience with banks, asset managers, and service providers, we’ve identified ten common pitfalls that repeatedly cause issues in PRIIP reporting.

1. Incomplete or Inaccurate Input Data

The quality of a PRIIP KID depends entirely on the quality of the underlying data. Missing or inconsistent market prices, volatilities, or product attributes often lead to incorrect scenario calculations or misleading risk indicators, undermining the reliability of the entire report.

2. Outdated Templates and Text Modules

Regulatory frameworks continue to evolve, but many institutions still use templates or standard texts that no longer reflect the latest PRIIPs RTS. This leads to inconsistencies in methodology, thresholds, or prescribed language, and can create compliance issues.

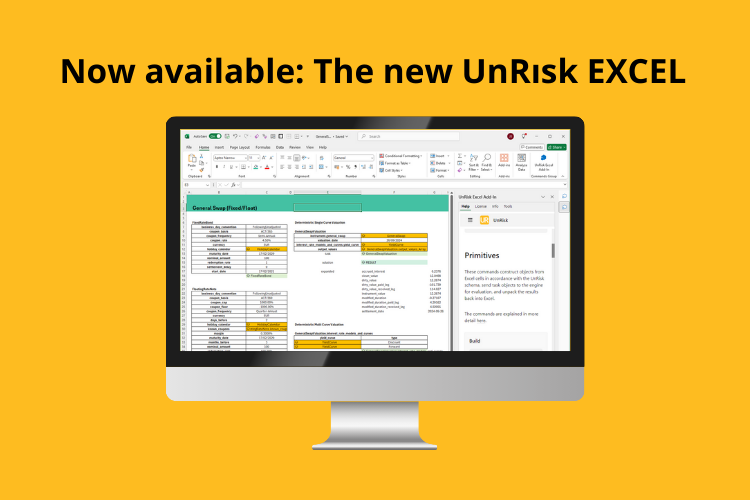

3. Static Scenarios Instead of Automated Calculations

Relying on manually created or outdated scenarios is still common, especially when reports are produced in Excel. Without regular recalculations and model-based projections, scenario outputs lose relevance, and KIDs become obsolete. Even worse: there are often no alerts when thresholds (such as SRI or performance indicators) are breached.

4. Lack of Transparency in Model Configuration

Transparency is essential, especially in market risk modelling (CRM approach). If assumptions, model parameters or calculation methods aren’t documented or traceable, trust diminishes both internally and externally. Full auditability of all figures is key to generating consistent, compliant KIDs.

Need help with PRIIP implementation?

We’ll show you how to produce PRIIP KIDs - simple, transparent, and scalable.

5. Manual Edits in the Final PDF

Final edits made directly in PDF files remain common practice. But manual changes increase the risk of formal errors, undermine automation efforts, and often bypass validation steps, especially when there’s no system in place to flag breaches of regulatory thresholds.

6. Incorrect Product Categorization

Many products are assigned to the wrong category (Cat. 1 vs. Cat. 2), which results in completely incorrect calculation methods. This is particularly critical for structured products, where categorization directly affects how performance scenarios are calculated.

7. Insufficient Data History

New products or underlyings often lack the required five years of price data for the CRM method. Many institutions underestimate the effort involved in sourcing high-quality historical data and end up using unsuitable proxy data.

8. Neglecting Cost Aggregation

Complex cost structures, especially in structured products, are often simplified or only partially included. Proper aggregation of various cost components (management fees, transaction costs, implicit costs) requires precise data integration from multiple sources.

9. Poor Translation Quality

For multilingual KIDs, automatic translations are often used without reviewing the financial terminology. But financial institutions cannot afford compliance violations due to linguistic inaccuracies.

10. Weak Governance and Review Processes

Missing four-eyes principles and the lack of systematic review processes before publication are an underrated risk. Studies show that 45% of companies don’t monitor compliance costs across the organization – a clear sign of inadequate governance structures.

The Compliance Reality: Numbers That Speak Volumes

Current compliance statistics highlight the urgency of professional PRIIP processes:

-

€10 trillion: Total volume of the European PRIIP market

-

1.3–3.3%: Share of payroll that US companies spend on regulatory compliance

-

$4,005,116: Average revenue lost due to non-compliance

-

2.71x: Multiplier by which non-compliance costs exceed compliance costs

-

60% cost increase: In compliance spending by banks since the financial crisis

Particularly alarming: 39% of compliance managers state that their teams are struggling to keep up with rapidly changing regulatory requirements.

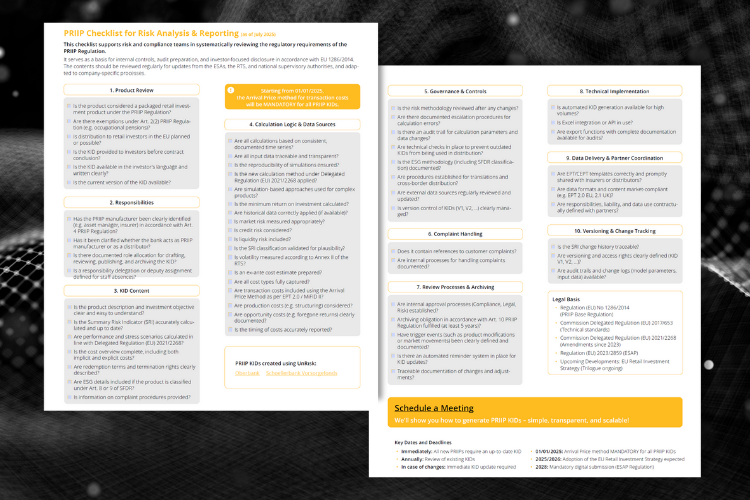

UnRısk’s PRIIP Checklist: Structure your Reporting Process

Understanding these common pitfalls is the first step.

Fixing them requires a reliable framework that covers data validation, automated KID generation, and integrated threshold monitoring.

To support you, we’ve created a free PRIIP checklist to help you stay compliant with evolving regulations.