ISO/IEC 27001: Verified Security Standards at UnRısk

20. May 2025

UnRısk PRIIPs for Hypo Tirol

24. June 2025

PRIIP Regulation Part 1: Comparing of risks and potential returns under PRIIPs

Preface to the series of articles

The PRIIPs regulation and, consequently, the obligation to compile PRIIPs key information documents, sometimes using complex mathematical calculations, has been a major concern of financial service providers and, in particular, PRIIPs manufacturers among them for a long time. In this multi-part series of articles, we will discuss the PRIIPs regulation, its benefits and some mathematical traps arising from the regulation. For detailed information and professional as well as technical support related to the implementation of the PRIIPs regulation, our specialists are happy to speak to you personally.

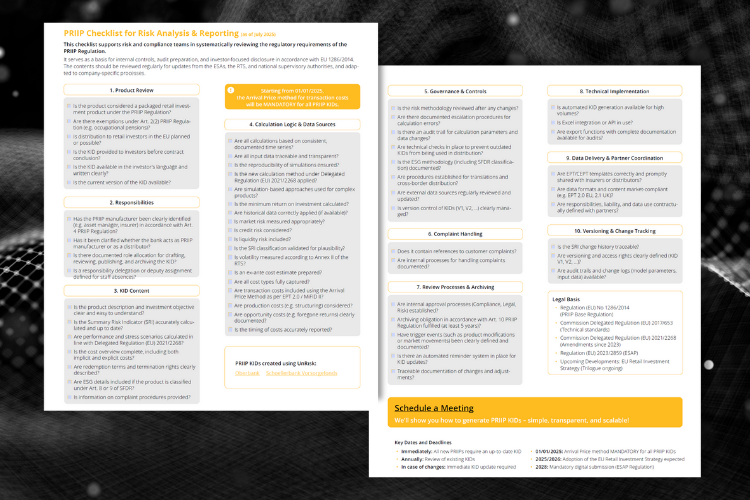

Need support with PRIIPs or KID generation?

Contact our experts today.

How can we compare the possible returns of different financial instruments?

In an ideal world for investors, wealth increases steadily without much fuss. However, different investment instruments are equipped with very different maturities, risk and return profiles. For a group of instruments, called the

Packaged Retail and Insurance-based Investment Products (PRIIPs)

the “Regulation (EU) on key information documents for packaged retail and insurance-based investment products (PRIIPs)” stipulates that each such PRIIP must be accompanied by a key information document (KID) in which the manufacturer quantifies the risk, the possible return and the costs associated with the product.

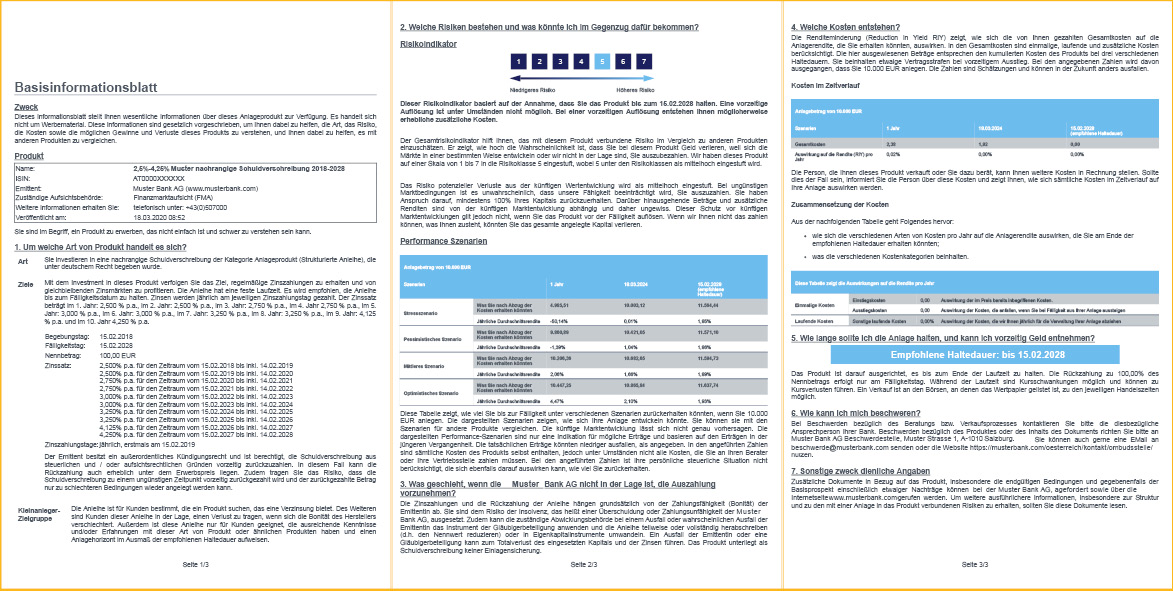

The aim of PRIIPs is to improve investor protection by standardizing pre-contractual information made available to private investors for investment products whose performance is based on the underlying assets. The key information document prescribed by the PRIIPs regulation is a short and standardized document that must not exceed three pages. It contains information about the type and characteristics of the product, its objectives and risk profile, costs and fees as well as potential returns. It must be kept separate from any marketing material.

KIDs can now be provided digitally, subject to specific technical standards for online delivery and accessibility requirements. According to the Implementing Regulation (EU) 2021/2268, specific technical requirements for digital presentation and accessibility must be met when delivering KIDs online.

Here is an example of a key information sheet (in German):

See how Hypo Tirol uses UnRısk PRIIPs to manage KIDs efficiently: Read the success story

Why should a non EU PRIIP manufacturer or PRIIPs distributor care about a European regulation?

On the one hand, the obligation to hand out a PRIIP key information document also applies to financial service providers from third countries such as Switzerland if they offer such products to private investors within the EU.

On the other hand, the new Swiss Financial Services Act (FIDLEG / FinSA) also stipulates that Swiss financial service providers must provide their customers with a basic information sheet on the financial products offered. In this regard, FinSA requires that an easily understandable basis information sheet has to be prepared for more complex financial instruments (including information on the type and characteristics of the financial instrument, risk and return profile and costs).

The requirements for the basis information sheet are largely based on the European regulations for key information documents, especially with regard to content and presentation. In the regulation on FIDLEG (FinSA), the Swiss legislature also states the explicit equivalence of documents under foreign law for PRIIPs key information sheets, which means that they can be used instead of a FinSA basis information sheet. This applies regardless of whether the product in question is also to be offered in the EU. This recognition of equivalence reduces the work involved in creating basis information sheets for the PRIIPs manufacturer, since they only have to create one basis information sheet at a time, regardless of the target audience.

Post-Brexit Considerations

Following Brexit, the UK has maintained similar requirements under its own regulatory framework. UK manufacturers selling PRIIPs to EU retail investors must still comply with EU PRIIPs regulations, while products sold in the UK follow the UK's adapted version of these rules.

What are examples of PRIIPs? What are examples that are not PRIIPs?

The key words are “Packaged” and “Retail”: If a (say: floating to fix) swap contract is offered to an institutional investor, then it is not a PRIIP. If a swap with the same terms and conditions is offered to a retail customer, then it is a PRIIP.

Likewise, if an instrument is not packaged, it is not a PRIIP. A single share of Apple is not a PRIIP, a German government bond is not a PRIIP, a bond paying Euribor coupons issued by UniCredit is not a PRIIP (assuming that coupons are set Vanilla style and no caps and floors are contained). Note: following the LIBOR transition in 2023, reference rates like €, STR, SOFR, and SARON are now commonly used.

On the other hand, an exchange-traded fund on DAX is a PRIIP (packaged), a callable fixed-rate bond from Goldman Sachs is a PRIIP (bond packaged with the right to terminate), and a floater with cap and floor is a PRIIP (floater packaged with caplets and floorlets ).

PRIIPs are also (this list is in no way complete, but only to be understood as examples):

Swaps, options, futures, securities funds, convertible bonds, structured reverse convertible bonds, structured interest rate instruments, unit-linked life insurance, and of course, all types of structured products according to the EUSIPA / SSPA classification.

Modern examples also include ESG-focused structured products, cryptocurrency ETFs and digital asset investment products, as well as green bonds with performance features linked to sustainability metrics. Note that while many PRIIPs today incorporate ESG features, the KID itself does not include sustainability-related disclosures under SFDR. Such information must be provided separately.

In addition to the PRIIPS Regulation, the Commission Delegated Regulation (EU) prescribes how the key information sheets are to be designed and which calculations have to be performed to obtain the numbers.

What categories of PRIIPs are there?

Before we can start the calculations, each PRIIP (if - see above - it is a PRIIP) has to be assigned to a category. This is regulated in Annex II of the Delegated Regulation:

- Category 1 instruments are those for which a total loss (or more) of the invested amount is possible, such as swaps, futures, options, and caps. Category 1 also contains instruments for which pricing occurs less frequently than monthly.

- Category 2 instruments are (leveraged or not) linear investments in an underlying, either physical or synthetic, with a sufficiently long time series of prices. Ideally, daily prices should be available for the last 5 years, either from the underlying itself or from a proxy or benchmark. Examples of category 2 instruments are actively managed equity funds or passive ETFS, or - we will come back to this in one of the following articles - a synthetic investment in Bitcoin.

- Category 3 instruments are non-linear investments in one or more underlyings for which a sufficiently long time series (or proxy, benchmark, as above) is available, such as structured interest rate instruments, structured foreign currency bonds, equity baskets.

- Category 4 instruments are those whose performance depends on variables that cannot be observed directly on the market, such as life insurance.

Which key figures must be calculated for the PRIIP and presented in the KID?

As we concentrate on the risk and return key figures necessarily contained in the KID, we briefly explain which key figures must be reported according to the PRIIP regulation. These include:

- the summary risk indicator (abbreviation SRI) is an integer value between 1 (low risk) and 7 (high risk), which is combined from a market risk value and a credit risk value

- the liquidity risk is described in a text module that explains the liquidity risk according to specific criteria

- the performance scenarios for different holding periods include an optimistic, moderate, and pessimistic scenario as well as a stress scenario

For the calculation of the individual key figures and notes, reference is made at this point to the detailed information in the regulation. We will come back to specific examples of category 2 and category 3 instruments in later posts within this series.

Is there really any benefit to the end customer?

The basic idea of PRIIPs is not only a good idea from the point of view of consumer protection, especially in the case of moderately to highly structured bonds, but even the gut feeling of experts may be far off, what the return might be after a few years of being invested. Of course, the scenario values are indicative, calculated based on the past, but the regulation makes forecast values more comparable.

Coming next: Category 2 instruments and the Cornish-Fisher ex

Subscribe to our Newsletter for the latest updates on PRIIPs methodologies and calculations

Coming next: Category 2 instruments and the Cornish-Fisher expansion

Subscribe to our Newsletter for the latest updates on PRIIPs methodologies and calculations.